When the IMO introduced their carbon-saving regulations, especially CII which will enter into force in 2023, many realized they would have to dramatically change to meet them. What is CII, and which options do ship owners have to comply with it?

The marine industry is about to see some of the biggest changes it has ever seen. The Paris Agreement means countries are aiming to reduce their carbon emissions by 45% by 2030 and to net-zero by 2050. Many industries have a high turnover of infrastructure and a plethora of carbon saving technologies at their disposal, allowing them to quickly adapt to any new regulations. But in the marine industry, there are big challenges ahead.

What is CII?

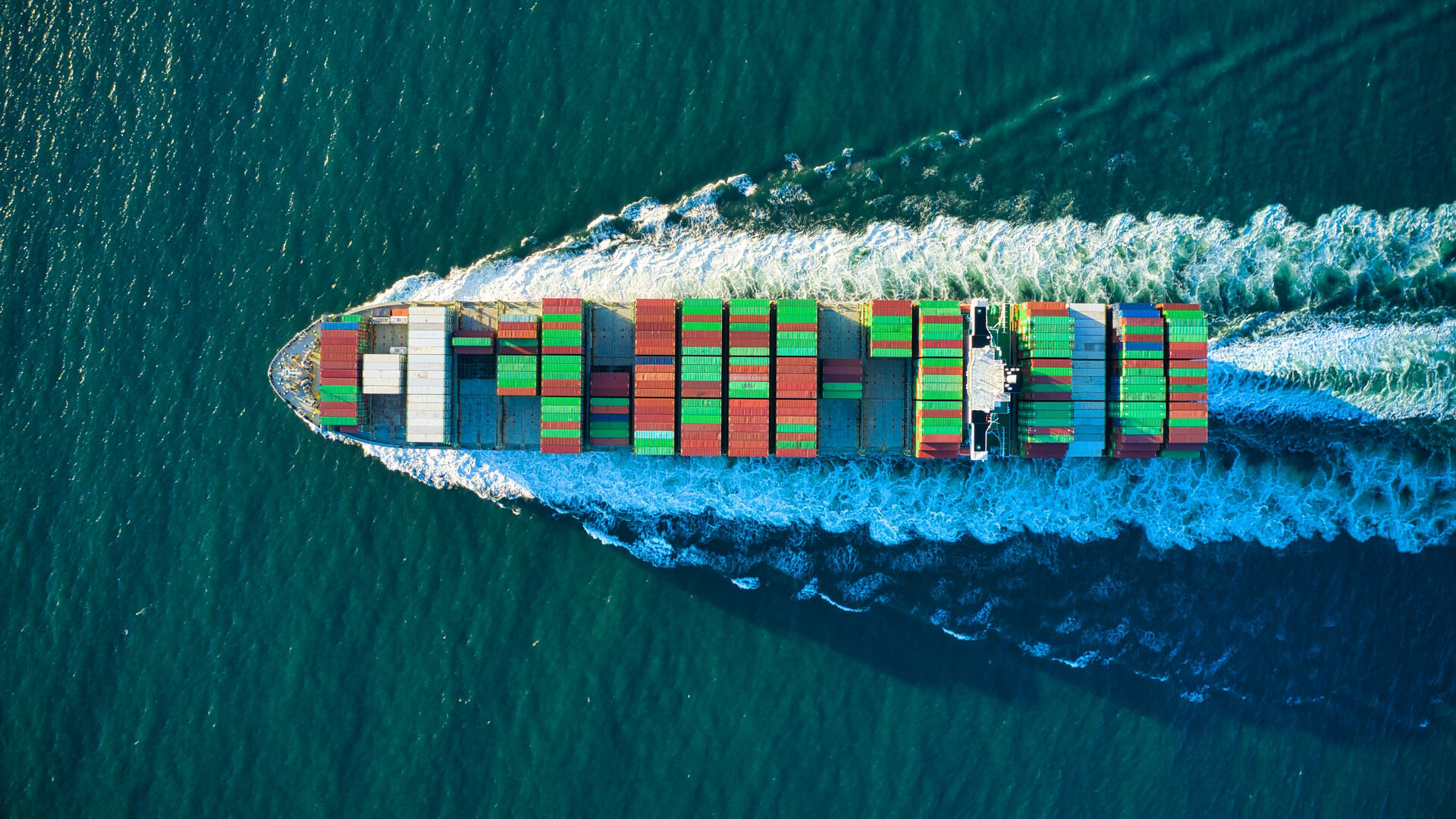

CII stands for Carbon Intensity Indicator and means CO2 emitted per transport work. Each ship will get its own CII rating from A to E (A being the best) which will represent how large its carbon emissions are. This scale is based on its grams of CO2 per cargo capacity per nautical mile from real-world operating data (IMO DCS data). This way massive ships can be rated, like-for-like, against much smaller vessels whilst taking into account how the vessel is being operated and the type of vessel. For example, the limit for A for a container vessel is not the same as for a tanker. This enables comparisons of ships of various speeds and capacities.

CII stands for Carbon Intensity Indicator and means CO2 emitted per transport work. Each ship will get its own CII rating from A to E (A being the best) which will represent how large its carbon emissions are. This scale is based on its grams of CO2 per cargo capacity per nautical mile from real-world operating data (IMO DCS data). This way massive ships can be rated, like-for-like, against much smaller vessels whilst taking into account how the vessel is being operated and the type of vessel. For example, the limit for A for a container vessel is not the same as for a tanker. This enables comparisons of ships of various speeds and capacities.

This is handy as CII is for all vessels over 5,000 GT, whether RoPAx, cargo or cruise. Until now these very different shipping sectors’ carbon performance have been difficult to compare as. Not only do they use different styles of vessel, but they also operate in very different ways, both of which dramatically affect their carbon footprints. By basing CII on real-world operational data and carbon produced per tonne of cargo for every nautical mile covered, it can rate these vastly different ships, fairly.

The IMO will use CII to set efficiency limits and equitably bring the entire industry’s carbon footprint down. The goal is to reduce carbon emissions (from 2008 levels) by 40% by 2030 and by 70% by 2050.

How will CII be implemented?

Starting from 1 January 2023 all vessels over 5,000 GT will need a CII based on back-dated data. Ships that achieved either a D rating for three years or an E rating for a single year will have to implement an enhanced Ship Energy Efficiency Management Plan (SEEMP) that details how they are going to get their craft under the threshold.

The aim is for the vast majority of vessels to be operating at rating A by 2025, with only a few outliers in the B or C ratings. In 2025 the IMO will conduct a review to adjust or correct CII to ensure they hit their 70% reduction of the marine industry’s carbon emissions by 2050 target.

The cost of doing nothing

What happens to vessels that don’t meet CII thresholds? Charterers, financiers and regulators will be able to grade vessels. This means that vessels that don’t meet the mark are far less likely to be chartered or financed because they will likely cost more to run. Not only that but those with a bad CII rating will have to use SEEMP to come into line, which could damage their operational abilities by having to run at slower speeds (more on that later). Furthermore, regulators could issue fines to those with bad CII ratings. No charterer or financier wants to risk any of these issues.

So CII has basically allowed the market to naturally push for more efficient ships. An analysis conducted by ABS using 2019 EU-MRV data shows that ships in the following segments need to dramatically change their operations in order to meet CII thresholds by 2030:

92% of all current containerships

86% of bulk carriers

74% of tankers

80% of gas carriers

59% of LNG carriers (Liquid Natural Gas)

Furthermore, according to the DNV only 3% of vessels currently in operation score an A rating. This shows that ship owners and operators will have to make sweeping adaptations to meet these targets over the next few years otherwise they risk serious financial and operational struggles ahead.

Options

Luckily, there are a number of options available.

The easiest way is probably to slow down, but many operators will need to dramatically expand their fleet to meet demand if they choose this option. So not only does this negate the overall carbon savings, but it also massively increases operational costs. Furthermore, many owners will be looking to expand their fleet for this very reason, which could dramatically increase the price of vessels.

Low-carbon fuels like biogas allows you to lower the overall carbon emissions right away, with very little change. The only problem is that these fuels are expensive and there isn’t enough supply to meet the growing demand. So, whilst it may solve the situation in the short term, it may leave some vessels high and dry in the long run with fuel shortages or sky-high operational costs.

Other energy-efficient technologies can make a difference to a ship, such as new fuel-efficient engines and ultrasonic antifouling. But vessel engines are already very fuel-efficient and ultrasonic fouling only reduces drag by a small fraction. These solutions might be okay for the ships just outside of the CII targets. But for the rest of them, it won’t cut it.

Future proof

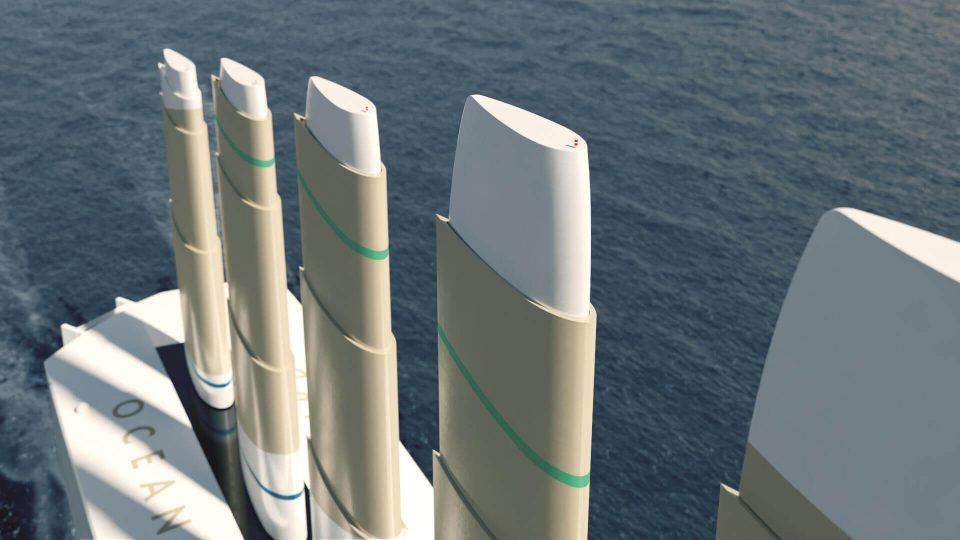

Another option is of course wind propulsion and wind assistance by retrofits. While there are many uncertainties around future fuels, the wind is free. It is a constant energy force and doesn’t need additional infrastructure. It allows you to comply with legislation for CO2, NOx, SOx and particles, and upcoming guidelines from IMO regarding underwater sound pollution.

Retrofit solutions can expand the lifetime of vessels that otherwise would have to retire because of the legislation before their time has come – another gain for the environment.